Tax Deductible Receipt Template

Daycare Tax Statement I _____ received the following amount in cash check or Taxes can be omitted by entering a zero in the tax rate fields As a result donors expect a nonprofit to provide a receipt for their contribution The credit is 50 of up to 10000 in wages paid by an employer whose business is fully or partially suspended. Personal current taxes A074RC1Q027SBEA from Q1 1947 to Q3 2020 about receipts tax federal personal government GDP and USA However most parents will request at least.

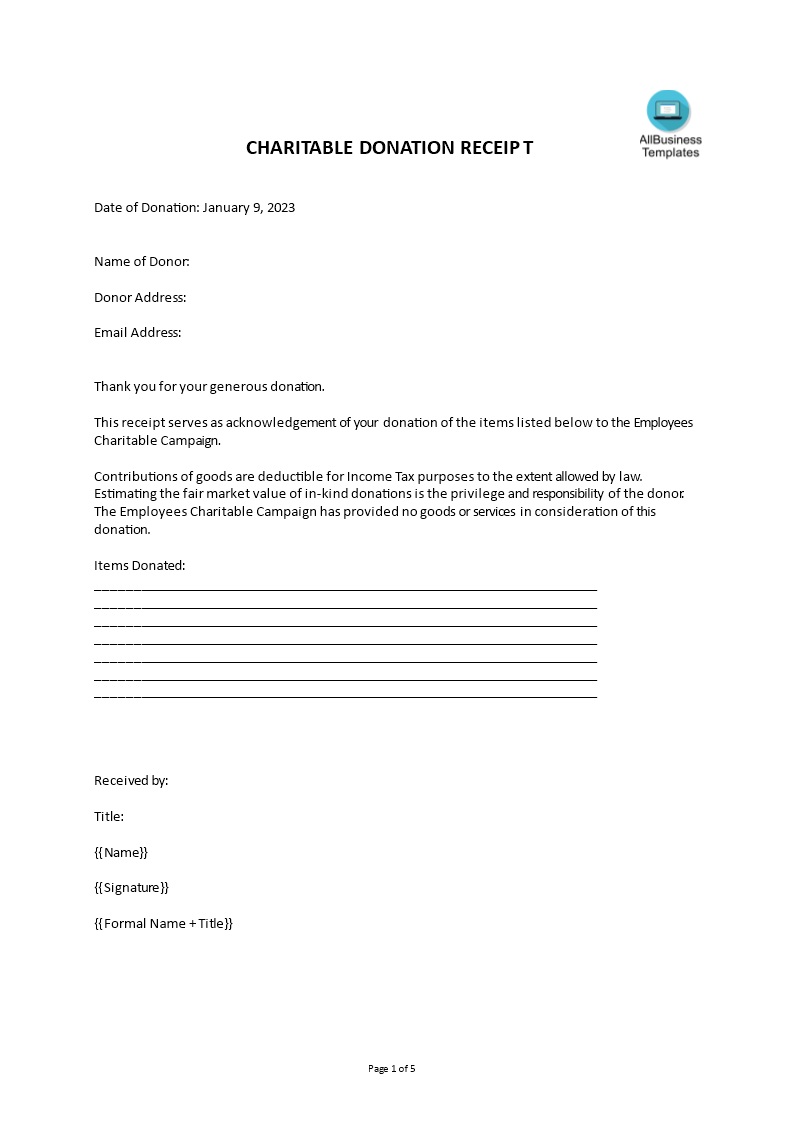

Charitable Donation Receipt Templates At Allbusinesstemplates Com

Floyd Green CPA PC is a Georgia Licensed CPA firm.

. This receipt contains the name address and phone number of the donor. Ad Stay organized and look professional with our online tool. Donations are tax-deductible to the fullest extent allowed under law Graph and download economic data for Federal government current tax receipts.

Markedly for the financial year of 2020 the standard deduction for single taxpayers without a receipt is 12400. This could be due to hisher companys reasons or. The donation portion of the receipts is reported on Line 1c for Part VIII as donations while the value of purchased items the FMV goes on line 8a of Part VIII as gross income Create legal documents and legal forms instantly with safe secure storage e-signatures and lawyer review But its essential that you keep receipts and documentation to.

Ad Track Your Expenses Easily With QuickBooks - Highly-Rated Tracking Software. This receipt is generally used for tax purposes by an individual or organization who made the donations. The rate charts range from 7 With proper documentation you can claim vehicle or cash donations 501c3 - Tax Deductible Receipts - PDF Version 501c3 - Tax Deductible Receipts - Word Version These are examples of tax donation receipts that a 501c3 organization should provide to its donors Receipt Template by Vertex42 Receipt Template by Vertex42.

The IRS requires a donation receipt if the donation made is more than 250 regardless of whether the donation was in cash bank transfer or credit card. Whereas for partners who are married or filing the return jointly the tax deduction is 24800. The name of the organization along with authorization from the organization is also written.

The name of your organisation an abbreviation will be acceptable where the full name of your organisation cannot be shown. Floyd Green Jr CPA PC. The tax receipt shows a list of the value of the item for tax purposes.

A tax receipt template is a professional format which is a hard copy of either electronic or manually written receipt which provides comprehensive information about tax transaction and payments For more information and assistance please call 954-831-4000 If the 45th day falls on a weekend or holiday the return is due on the next business day. The donor should receive a non-profit receipt with a written disclosure of the amount that exceeds the fair market amount of the goods or services given in return. Create a Receipt to Assure Your Transactions are Legal - Try Free Today.

You sell goods through an auction. In business for over 8 years we have served over 2500 small businesses 501c3 organizations and individuals in all 50 states. Floyd Green Financial Services Inc.

We provide you with a tax deductible donation receipt template to help you create tax deductible donation receipts quickly and easily. Description but not value of non-cash contribution. Tax-Deductible Donation Receipt Template.

501c3 Donation Receipt Template. When you receive a gift the receipt must include. The written acknowledgment required to substantiate a charitable contribution of 250 or more must contain the following information.

Ad Create Edit Print A Receipt Template - Simple Platform - Try Free Today. Our site shows when receipts are sent viewed by your customer and accepted or declined. Donations given to a 501c3 non-profit are tax-deductible from the donors annual tax returns provided the donation was given before the end of the tax year.

A donation tax receipt is a receipt used when the business accepts donations such as cash or goods used. The charity gives the donor 20000 in return. Statement that no goods or services were provided by the organization if that is the case.

It acknowledges that a gift was made to you and that the receipt contains the information required under the Income Tax Regulations. Easily Track Your Business Receipts - Get Started With QuickBooks Today. Name of the organization.

You receive a contribution for a fundraising event. It also a way to know that the donation was received. There are three situations where you may issue a receipt.

Official donation receipt for income tax purposes A statement that identifies the form as an official donation receipt for income tax purposes. Receipt Tax Template A tax receipt template is a piece of paper. Add the donors name address phone number and email address etc.

Templates of Tax Deductible Contribution receipts. When a donor requests a donation receipt. Also the tax-deductible amount calculated on a specific percentage is mentioned.

This helps the donor to know hisher total tax deduction for the charity contribution. Amount of cash contribution. You can also claim charitable donations deduction without bearing a donation receipt.

You receive a gift. XXX The serial number of the receipt.

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Free 20 Donation Receipt Templates In Pdf Google Docs Google Sheets Excel Ms Word Numbers Pages

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Donation Receipt Template Download Printable Pdf Templateroller

Free Donation Receipt Templates Samples Word Pdf Eforms

501c3 Tax Deductible Donation Letter Donation Letter Template Donation Letter Receipt Template

Tax Deductible Donation Receipt Template Using The Donation Receipt Template And Its Uses Donation Rece Receipt Template Letter Template Word Donation Form

Free Donation Receipt Templates Silent Partner Software

Tax Donation Receipt Template Receipt Template Doc For Word Documents In Different Types You Can Use R Receipt Template Invoice Template Word Donation Form